Optimized inventory requires a fine balance between excess stock and insufficient inventory to meet customer needs. You also benefit from better liquidity, meaning there’s more cash available for other operations. By calculating DIO, you can also identify inefficiencies in inventory management and facilitate budget planning and cash flow management. Investors and analysts will use DIO to gauge your company’s performance. Days Inventory Outstanding (DIO) measures the average number of days it takes for a company to sell its entire inventory during a specific period.

Improve sales processes

- The average inventory turnover and DIO varies by industry; however, a higher inventory turnover and lower DIO is typically preferred as it implies the management of inventory is closer to an optimal state.

- The days inventory outstanding metric can be valuable to businesses that manage inventory, but the results shouldn’t be used in a bubble.

- The Days Inventory Outstanding (DIO) is the number of days it takes on average before a company needs to replace its inventory.

- If you’re trying to work out what a ‘good’ DIO is for your business, compare it with similar organisations from the same sector.

- We are constantly aware that our work has an impact on the communities we serve and that we have a duty to help and support others.

Manufacturing thus typically has longer DIO because of production times. The concept of days inventory outstanding explains the number of days that a business will hold its inventory with itself before selling it to the customers. Days inventory outstanding, or DIO, is a measure of how quickly a company can turn its inventory into sales. The days inventory outstanding definition is the average time it will take for the company to sell its inventory to its customers or clients.

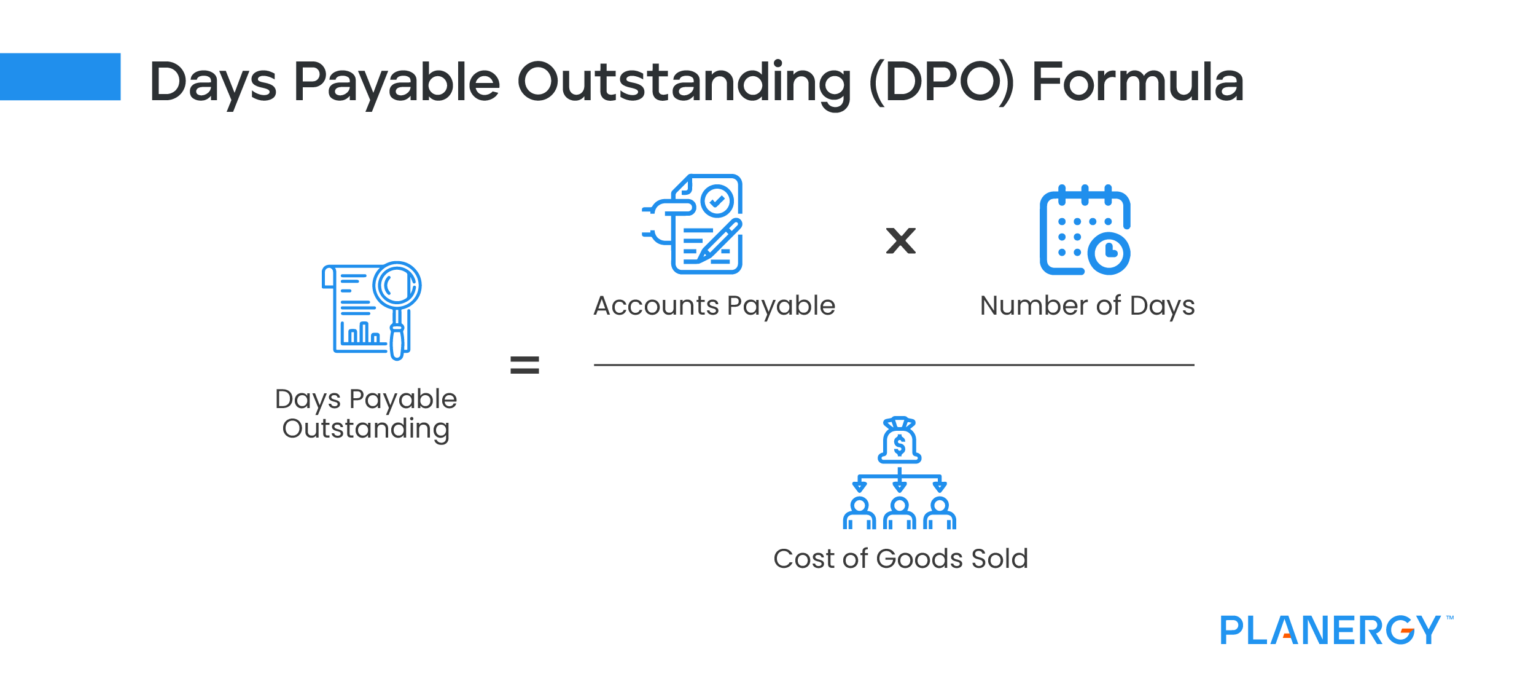

Days Inventory Outstanding formula

DIO won’t give a direct understanding of profitability in the same way profitability ratios will, but it is useful none the less. Likewise, if the standard DIO is 50 and your company’s DIO is 65, then your DIO would be considered high. Now that you have all of the necessary totals, you’re ready to calculate the DIO. If you were calculating DIO for the year, the total number of days would be 365. Utilize data analytics and machine learning to uncover patterns and trends in management.

Strategies for Optimizing Inventory Days

DSI is also known as the average age of inventory, days inventory outstanding (DIO), days in inventory (DII), days sales in inventory, or days inventory and is interpreted in multiple ways. Indicating the liquidity of the inventory, the figure represents how many days a company’s current stock of inventory will last. Generally, a lower DSI is preferred as it indicates a shorter duration to clear off the inventory, though the average DSI varies from one industry to another. While DIO reflects the average number of days it takes to turn over your inventory, the inventory turnover ratio tells you how many times inventory is sold and replaced in a given period (e.g. a quarter).

This information can be used to adjust inventory levels and make more strategic purchasing decisions, ultimately leading to increased profitability. Furthermore, DIO can be used to compare a company’s inventory management performance to its industry peers. If a company’s DIO is significantly higher than its competitors, it may indicate that the company has inefficient inventory management practices that need to be addressed. Days Inventory Outstanding is a metric that indicates the average number of days a company’s inventory is held before it is sold. Businesses can use this metric to calculate how well they are managing their inventory and how efficiently they are putting their assets to work. Typically, companies that have a low DIO ratio are considered to be more efficient at managing their inventory and generating revenue.

Income Statement Assumptions

A DIO that is lower than this indicates that the company is selling its inventory quickly, which can help to improve cash flow and profitability. A DIO that is higher than this indicates that the company may be holding onto inventory for too long, which can tie up cash and increase the risk of inventory obsolescence. However, you can’t rely solely on the findings from your DIO to make decisions. Utilising DIO to calculate your cash conversion cycle can build a more accurate picture of sales and inventory performance over time. Tracking the Days Inventory Outstanding metric is a useful activity for understanding the liquidity of your business in each accounting period. The results can help you identify inventory bottlenecks and make informed decisions to increase workplace efficiency.

Conversely, a different method to calculate DIO is to divide 365 days by the inventory turnover ratio. DIO stands for “Days Inventory Outstanding”, and measures the number of days required for a company to sell off the amount of inventory it has on hand. If they’re not important to your business, transferring the focus from these laggards to more high-demand, cost-effective products can greatly improve DIO and revenue over time. Analyse your sales data using inventory software reports to identify which products are causing the most issues.

Collaboration with suppliers also enhances forecast accuracy, ensuring timely replenishment and meeting order fulfillment rates. For growing businesses that make or sell physical products, inventory is one of the biggest operating expenses that affect liquidity. To stay competitive in the market, it’s important to understand and track business metrics that measure inventory efficiency and provide cash flow insights. DSI and inventory turnover ratio can help investors to know whether a company can effectively manage its inventory when compared to competitors. A stock that brings in a higher gross margin than predicted can give investors an edge over competitors due to the potential surprise factor.

Therefore, it is important to compare the value among the same sector peer companies. Companies in the technology, automobile, and furniture sectors can afford to hold on to their inventories for long, but those in the business of perishable or fast-moving consumer goods (FMCG) cannot. He is a small business owner with a background average days inventory outstanding in sales and marketing roles. With over 5 years of writing experience, Josh brings clarity and insight to complex financial and business matters. You can also look at diversifying sales channels to push existing inventory through the pipeline faster, including partnering with retailers or investing in ecommerce marketing programs.

Typically, manufacturing and retail companies have a higher DIO than other industries. However, it is imperative to note that the benchmarks will differ between companies and industries. Seasonal demand is common across many industries, and maximizing sales during peak periods relies heavily on accurate inventory forecasting.